When you fill a prescription for metformin, lisinopril, or levothyroxine, you’re probably getting a generic version. That’s not by accident. It’s the result of a powerful economic force: multiple generic manufacturers competing to sell the same drug. And that competition? It’s what keeps prices low-sometimes shockingly low.

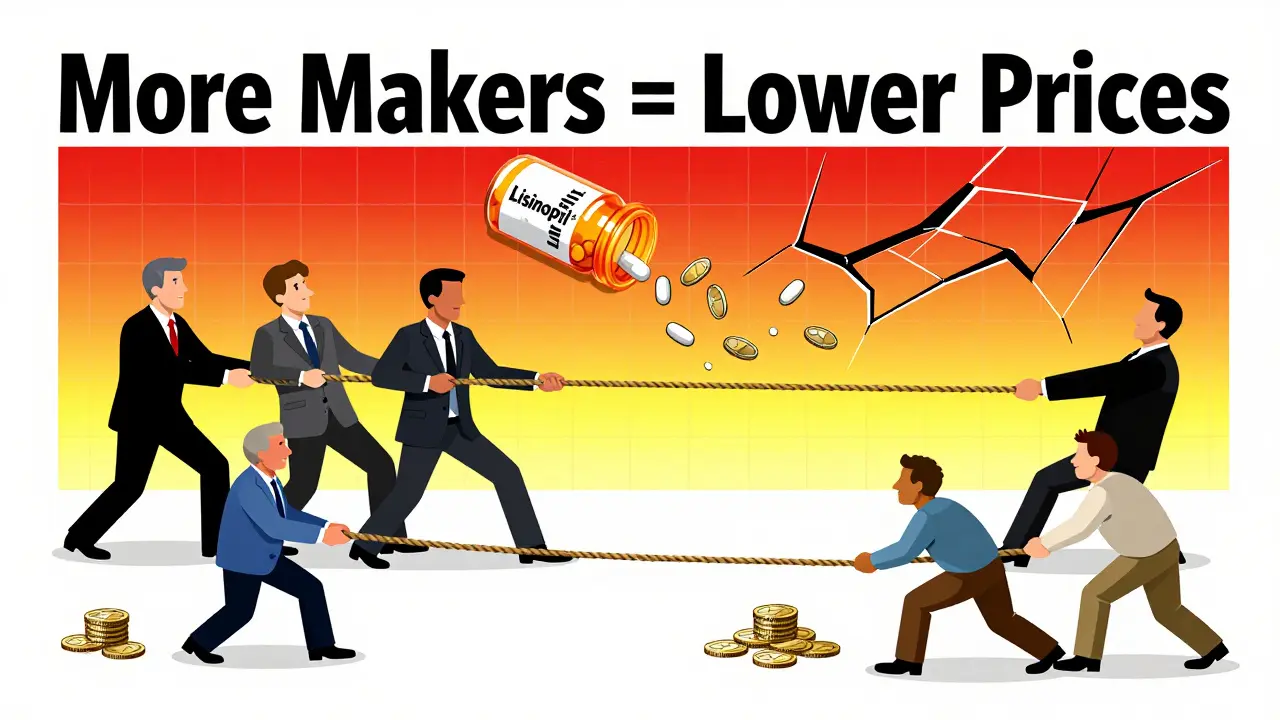

One maker, high price. Five makers, pennies.

Think about it this way: if only one company made your blood pressure pill, they could charge whatever they wanted. But when five or six other companies start making the exact same thing-same active ingredient, same dosage, same effect-the game changes. Suddenly, each one has to undercut the others just to stay in the game. A 2021 study in JAMA Network Open looked at 50 brand-name drugs after generics entered the market. The results were clear:- One generic competitor? Price dropped by 17%.

- Two generics? Down 39.5%.

- Three generics? Down 52.5%.

- Four or more? Prices fell by 70.2% on average.

Why does more competition mean lower prices?

It’s basic economics: supply goes up, price goes down. But in the drug world, it’s even more dramatic because the product is identical. A pill made by Teva, Mylan, or Sandoz works the same way. There’s no difference in effectiveness. So why would a pharmacy or a patient pay more for one brand over another? Manufacturers know this. So they race to offer the lowest price. The first generic to enter usually gets a small premium-maybe 20-30% below the brand. But by the time the third or fourth company joins, prices start to plummet. By the sixth or seventh? The drug can be priced at 90% less than the original brand. The FDA estimates that over the decade ending in 2019, generic drugs saved the U.S. healthcare system $1.7 trillion. That’s not a guess. That’s based on real data from Medicare, private insurers, and pharmacy sales. In 2022 alone, 742 new generic approvals were expected to save $14.5 billion annually. That’s billions of dollars back into patients’ pockets, insurers’ budgets, and public health programs.But not all generics are created equal

Here’s the catch: this magic only works when there are enough competitors. If only one or two companies make a drug, prices don’t drop much. In fact, they can stay high-or even spike. A 2017 study by MIT, University of Chicago, and University of Maryland found that more than half of all generic drugs had only one or two manufacturers. That’s a problem. When only one company makes a drug, they have no pressure to lower prices. And if that one company runs into trouble-say, a factory shutdown or quality issue-prices can jump 300% overnight. There are real stories behind those numbers. One patient on a forum in 2023 described how the epilepsy drug levetiracetam went from $45 to $220 a month after three of the five manufacturers quit the market. Another Reddit user said their insulin generic went from $25 to $150 after the only supplier cut production. These aren’t rare cases. They’re symptoms of a system that’s losing competition.

Why do some drugs have so few makers?

It’s not because no one wants to make them. It’s because the profit margins are thin. Making a generic drug isn’t cheap. You need FDA approval, manufacturing facilities, quality control, and distribution. But if the price is already down to pennies per pill, there’s not much left for profit. So many small companies get bought out by bigger ones. Between 2014 and 2016, nearly 100 generic manufacturers merged or were acquired. The result? Fewer players, less competition, and less pressure to cut prices. The FDA and FTC have flagged this as a growing risk. In 2021, the FTC challenged several mergers in the generic space, worried that consolidation would lead to monopolies. And it’s not just about small companies disappearing. Even big ones walk away from certain drugs. If a generic only brings in $800,000 a year in revenue (as one study found), it’s not worth the hassle. So they drop it. And suddenly, you’re left with one maker-and a price hike.What about complex drugs? Biologics and injectables

Not all drugs follow this pattern. Simple pills-like antibiotics or cholesterol meds-are easy to copy. But biologics (like Humira or Enbrel) and injected generics are harder to replicate. That’s why biosimilars (the generic version of biologics) have moved slowly and rarely cut prices as much. The same JAMA study found that if biosimilars were treated like regular generics under Medicare, spending on those drugs would’ve been 27% lower between 2015 and 2019. But because they’re more complex and regulated differently, manufacturers have less incentive to compete aggressively. The same goes for infused or injected generics. Fewer companies make them. Prices stay higher.

What can you do?

You don’t need to be an economist to benefit from generic competition. Here’s how to make sure you’re getting the lowest price:- Ask your pharmacist: Is there more than one generic available? If only one, ask if another is coming soon.

- Use price checkers: Tools like GoodRx compare prices across 70,000 pharmacies. You might find the same drug for $5 at one store and $45 at another.

- Check the FDA Orange Book: It lists which generics are rated “AB” - meaning they’re therapeutically equivalent to the brand. Avoid BX-rated versions unless your doctor says it’s safe.

- Ask about therapeutic substitution: In most states, pharmacists can swap one generic for another. But for drugs with narrow therapeutic windows (like warfarin or seizure meds), your doctor may need to block it.

The bigger picture: Savings vs. risk

The system works best when there’s healthy competition. More manufacturers = lower prices = more people getting their meds. But when consolidation happens, the savings vanish-and so does access. The FDA’s Drug Competition Action Plan (2017) and the CREATES Act (2019) were designed to stop big companies from blocking generic entry. But enforcement is slow. And small manufacturers still struggle to survive. The good news? For most common pills, competition is still strong. The bad news? It’s disappearing for the drugs that matter most to vulnerable patients.What’s next?

The FDA’s new Generic Drug User Fee Amendments (GDUFA III), running through 2027, aim to speed up approvals and encourage more manufacturers to enter the market. If it works, we could see more generics hit shelves faster-and prices drop even further. But the real test will be whether regulators can stop the mergers before they happen. Because once a market has only one or two makers, it’s nearly impossible to bring competition back. For now, the message is simple: more generic manufacturers mean lower prices. And if you’re on a generic drug, you’re already saving money-because someone else is competing to give you the same pill for less.Why do generic drug prices drop so much when more companies make them?

Generic drugs are chemically identical to brand-name drugs, so there’s no difference in effectiveness. When multiple companies make the same drug, they compete on price to win pharmacy and patient business. The more competitors, the harder each one has to push prices down to stay in the market. Studies show that with four or more manufacturers, prices often fall by 70% or more compared to the original brand.

Can generic drug prices go up even after competition starts?

Yes-if competition disappears. If a manufacturer shuts down, exits the market, or gets bought out, the number of makers drops. When only one or two companies are left, they can raise prices without fear of losing customers. This has happened with drugs like levetiracetam and insulin, where prices spiked 300-500% after manufacturers left the market.

Are all generic drugs the same?

In terms of active ingredients and effectiveness, yes-FDA requires generics to be bioequivalent to the brand. But not all generics are rated the same. The FDA’s Orange Book labels them as AB (therapeutically equivalent), A (equivalent but with minor differences), or BX (not equivalent). Always ask your pharmacist to confirm your prescription is AB-rated unless your doctor says otherwise.

Why don’t more companies make generic drugs?

Making generics is expensive and low-margin. FDA approval, manufacturing, and distribution cost millions. If a drug’s price is already down to pennies per pill, profit is slim. Many small manufacturers get bought by bigger ones, or simply quit making drugs that don’t bring in enough revenue-sometimes as little as $800,000 a year.

How can I find the cheapest generic version of my medication?

Use free tools like GoodRx or SingleCare to compare prices at nearby pharmacies. Prices can vary wildly-even for the same generic. Also, ask your pharmacist if another generic version is available. Sometimes switching to a different manufacturer can cut your cost in half. And don’t forget: mail-order pharmacies often offer better deals for 90-day supplies.

Janette Martens

December 30, 2025 AT 00:43generic drugs r the only reason i can afford my meds lmao why tf do we let big pharma buy up all the small makers???

Marie-Pierre Gonzalez

December 31, 2025 AT 18:59Thank you for this meticulously researched and profoundly important overview. The systemic erosion of generic market competition is not merely an economic concern-it is a public health emergency. I urge all readers to advocate for stronger antitrust enforcement and support legislation that protects small manufacturers. The lives of millions depend on it.

Louis Paré

January 1, 2026 AT 19:10Let’s be real-this whole ‘competition lowers prices’ thing only works when the government doesn’t screw it up. The FDA’s approval process is a bureaucratic nightmare. Companies don’t exit because profits are low-they exit because the cost of compliance is absurd. Fix the regulator first, then worry about the market.

Nicole Beasley

January 3, 2026 AT 18:42Just checked GoodRx for my levothyroxine-$4.99 at Walmart, $42 at CVS. 😳 I had no idea prices varied that much. Also, my pharmacist said there are 12 different generics available. Mind blown. 🤯

sonam gupta

January 4, 2026 AT 00:35India makes 60 of the world's generics and still we pay more than other countries. Why? Because US pharmacy benefit managers are rigged. No competition. Just greed.

Julius Hader

January 4, 2026 AT 18:58People don’t realize how lucky they are to have cheap generics. Back in the 90s, my dad had to choose between food and his blood pressure med. Now? He gets 90 days for $5. That’s not magic. That’s competition. And we should protect it.

Vu L

January 5, 2026 AT 15:12Yeah but what if the generic is made in a factory that got shut down for safety violations? Are you really okay with that just to save $10?

James Hilton

January 6, 2026 AT 04:16Generic drugs: the only time capitalism actually works for the people. 🤷♂️

Mimi Bos

January 7, 2026 AT 22:28Wait so if i switch from one generic to another its totally fine? I thought they were all different? I just always took the one my dr gave me...

Payton Daily

January 9, 2026 AT 19:46Let me break this down for you like you’re five. Imagine 10 people selling identical apples. One says $10. Then someone says $8. Then $5. Then $2. Then $1. Then $0.50. Everyone’s scrambling to sell. That’s generics. Now imagine 1 person sells apples. They say $50. No one can compete. That’s what happens when companies merge. And yes, it’s evil. And yes, it’s happening right now. And no, your senator doesn’t care.

Kelsey Youmans

January 10, 2026 AT 04:00While the data presented here is compelling, one must also consider the downstream implications on pharmaceutical innovation. The erosion of profit margins in the generic sector may inadvertently disincentivize investment in novel therapeutics. A balanced regulatory framework is essential to preserve both access and advancement.

Sydney Lee

January 11, 2026 AT 21:39It’s not just about price-it’s about dignity. When a single manufacturer controls a life-saving drug, they hold power over human survival. That’s not capitalism. That’s feudalism with a pharmacy logo. The fact that we tolerate this in the 21st century is a moral failure. And no, ‘market forces’ don’t absolve us of responsibility.