When you pick up your prescription, you expect it to be covered. But what if your insurance suddenly says no-because your drug moved from Tier 2 to Tier 4? Or your pharmacist handed you a different pill because it’s cheaper? That’s not a mistake. It’s insurance formulary policy in action.

What Exactly Is a Formulary?

A formulary is simply a list of drugs your insurance plan will pay for. It’s not random. Every drug on that list has been reviewed by doctors, pharmacists, and cost experts to balance effectiveness, safety, and price. In the U.S., nearly all Medicare Part D and private health plans use formularies. They’re not optional-they’re required by law.Think of it like a menu. Not every dish is available. Some are cheap and easy to get (Tier 1). Others cost a lot more and need extra paperwork (Tier 4). The goal? Keep drug prices down for everyone, but that doesn’t always mean better outcomes for you.

The Four Tiers: How Much You Really Pay

Most formularies split drugs into four tiers. Each tier changes how much you pay out of pocket-sometimes by hundreds of dollars.- Tier 1: Generics - Usually $10-$15 per prescription. These are the same active ingredients as brand names, just cheaper. Most plans put the most common generics here.

- Tier 2: Preferred Brand-Name Drugs - $40-$50. These are brand-name drugs your insurer has negotiated a good deal on. They’re still covered, but not as cheaply as generics.

- Tier 3: Non-Preferred Brand-Name Drugs - $70-$100. These are brand-name drugs your plan doesn’t push. Maybe they’re newer, or the manufacturer didn’t offer a big enough discount.

- Tier 4: Specialty Drugs - 33% coinsurance. This is where things get expensive. Drugs for cancer, MS, or rheumatoid arthritis often land here. You don’t pay a flat fee-you pay a percentage of the total cost. For a $5,000 monthly drug, that’s $1,650 out of your pocket. No annual cap means your bill could hit $20,000 a year.

One study found patients moving from Tier 1 to Tier 4 saw their out-of-pocket costs jump 300-500%. That’s not a typo. It’s standard.

Open, Closed, and Partially Closed: Which One Are You On?

Not all formularies are built the same. There are three main types:- Closed Formularies - Only drugs on the list are covered. If your medication isn’t there, you pay full price unless you get an exception. About 65% of Medicare Part D plans use this model. It saves money-for the insurer.

- Open Formularies - Cover almost all drugs, even ones not on the list. But your premiums? Higher. Usually 12-15% more than closed plans. Good if you take rare or expensive meds, bad if you’re trying to keep monthly costs low.

- Partially Closed - A middle ground. Some drugs are blocked, others aren’t. Often used by employer plans. They try to balance cost and access, but the rules can be confusing.

Here’s the kicker: the same drug can be in Tier 2 on one plan and Tier 3 on another. A 2022 analysis found cost differences of $30-$60 per prescription just from switching plans. That’s $360-$720 a year-just for one pill.

Substitution Laws: When Your Pharmacist Changes Your Prescription

You walk into the pharmacy. The pharmacist says, “We can give you a different version of this drug.” That’s therapeutic substitution. And in 31 states, they’re legally allowed to do it-without asking your doctor.It’s not always bad. If you’re on a generic, substitution is safe and common. But if you’re on a brand-name drug, especially for conditions like epilepsy, thyroid disease, or autoimmune disorders, even small changes in formulation can cause side effects or make the drug less effective.

A 2023 study found substitution happens in 18% of prescriptions. For 5-7% of patients with complex conditions, it leads to treatment disruptions. One patient on Reddit shared how their Humira (a biologic for rheumatoid arthritis) was switched to a biosimilar without warning. Within weeks, their pain returned. Their doctor had to restart the approval process. That took six weeks.

Some states require pharmacists to notify you and your doctor before substituting. Others don’t. You need to ask: “Can you tell me if this is a substitution?”

What’s Blocking Your Access? Prior Auth, Step Therapy, Quantity Limits

Even if your drug is on the formulary, you might still be blocked. Here’s how:- Prior Authorization - Your doctor has to call or fax the insurer to prove you need this drug. The AMA says 82% of doctors face delays from this. In 34% of cases, those delays led to serious health events.

- Step Therapy - You have to try cheaper drugs first. Even if you’ve tried them before and they didn’t work. Your insurer doesn’t care. They want you to test the cheapest option first.

- Quantity Limits - You can only get 30 pills a month, even if your doctor prescribed 90. You have to pay out of pocket for the rest-or wait for approval.

Medicare Part D patients get exceptions approved 73.2% of the time-but the process takes an average of 7.2 business days. For someone with cancer or heart failure, that’s dangerous.

Real People, Real Costs

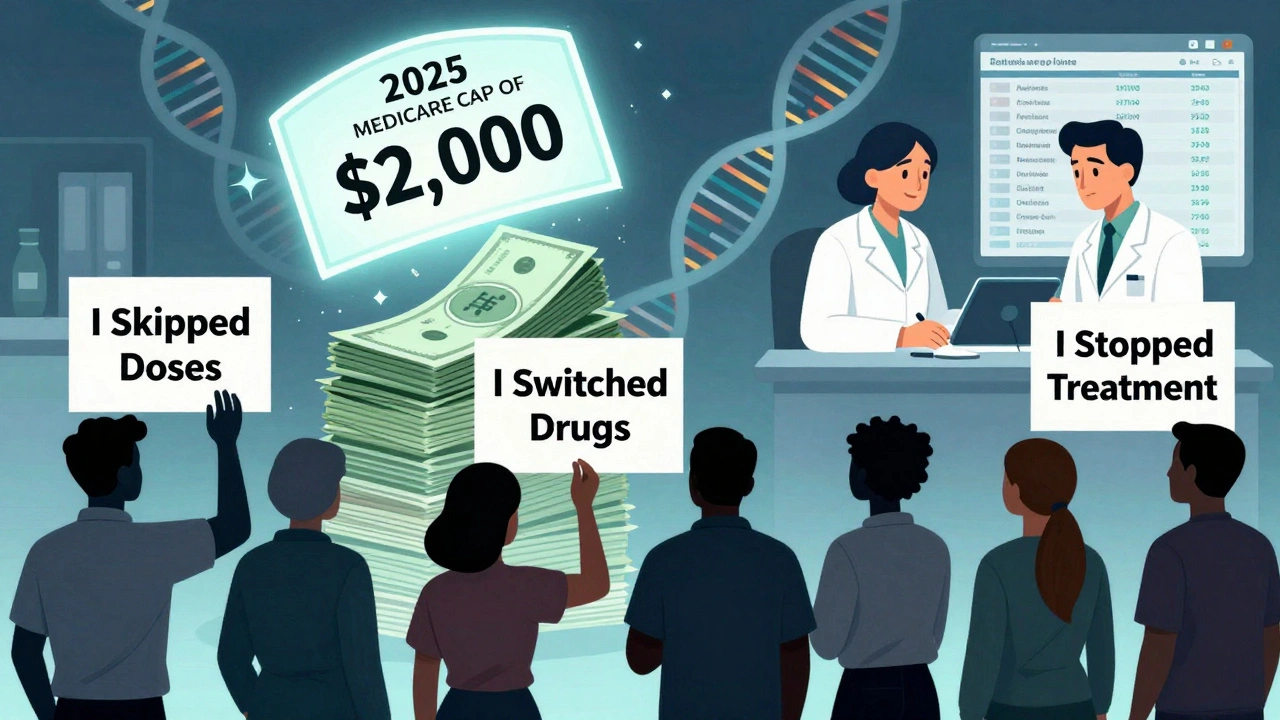

A 2023 GoodRx survey of 1,500 patients found:- 68% had at least one formulary-related problem in the past year

- 42% skipped doses because they couldn’t afford them

- 29% switched to a less effective drug

- 18% stopped treatment entirely

One user on Trustpilot wrote: “My medication was covered one month and excluded the next-with no notice.” That’s not rare. A 2023 CMS audit found 43% of formulary changes happen without direct patient notification.

On the flip side, people who use tools like Medicare Plan Finder save an average of $472 a year just by comparing plans. Those who check their drug’s tier before signing up save $1,200 annually.

What You Can Do: Action Steps

You can’t control the formulary. But you can control how you respond.- Check your formulary every year - During open enrollment (Oct 15-Dec 7 for Medicare, Nov 1-Jan 15 for ACA plans), log in to your insurer’s website and search every drug you take. Don’t assume it’s still covered.

- Ask about substitution - When picking up a prescription, ask: “Is this the same drug my doctor prescribed?” If it’s not, call your doctor immediately.

- Use the exception process - If your drug is denied, your doctor can file an exception. 73% get approved. But you need documentation. Don’t wait-start the process as soon as you’re denied.

- Know your tier - If you’re on Tier 4, talk to your doctor about alternatives. Maybe there’s a similar drug in Tier 2. Or ask if a biosimilar is an option.

- Use free tools - GoodRx, Medicare Plan Finder, and your insurer’s online portal can show you real-time prices and tier status. Use them.

What’s Changing in 2025 and Beyond

The rules are shifting fast. Starting January 1, 2025, Medicare Part D will cap out-of-pocket drug costs at $2,000 a year. That’s huge. It means even Tier 4 drugs won’t bankrupt you.By 2026, all Part D plans must show you your exact cost at the point of prescribing-right when your doctor writes the script. No more surprises at the pharmacy.

And by 2025, formulary documents will be cut from 287 pages to just 4. They’re finally making them readable for patients.

The future? Formularies may start using genetic data to personalize tiers. If your DNA shows you respond better to Drug A than Drug B, your plan might put A in Tier 1-even if it’s more expensive. That’s not sci-fi. It’s coming.

Final Thought: It’s Not Just About Cost

Insurance formularies aren’t evil. They help keep premiums lower for everyone. But when access to life-saving drugs is locked behind tiers, paperwork, and pharmacist substitutions, the system fails the people it’s supposed to protect.You’re not powerless. Know your drug’s tier. Ask questions. Fight for exceptions. And never assume your coverage stays the same. Every year, the rules change. So should your strategy.

What happens if my drug is removed from the formulary?

If your drug is removed, your insurer must notify you before the change takes effect. You can file an exception request with your doctor’s help. About 73% of these requests are approved. If denied, you can appeal. In the meantime, ask your doctor for a similar drug on the formulary or explore patient assistance programs.

Can my pharmacist substitute my medication without telling me?

In 31 states, yes-pharmacists can swap your brand-name drug for a cheaper generic or biosimilar without your doctor’s approval. But they’re not always required to tell you. Always ask: “Is this the same drug my doctor prescribed?” If it’s not, contact your doctor right away.

Why does the same drug cost more on one plan than another?

Each insurer negotiates separately with drugmakers. A drug might be in Tier 2 on Plan A because the insurer got a big discount, but Tier 3 on Plan B because they didn’t. Even small differences in tier placement can mean $30-$60 more per prescription. Always compare plans during open enrollment.

How do I find out which tier my drug is on?

Log in to your insurer’s website and use their formulary lookup tool. You can also call member services. For Medicare plans, use the Medicare Plan Finder tool. It’s free, accurate, and shows tier info, copays, and pharmacy networks-all in one place.

Are there drugs that are always covered, no matter the plan?

Yes. Medicare Part D plans must cover all vaccines recommended by the CDC with $0 out-of-pocket cost. Also, insulin costs are capped at $35/month starting in 2023. Some states require coverage for certain cancer drugs or mental health medications regardless of formulary rules.

Can I switch plans mid-year if my drug is dropped?

Normally, no-you can only switch during open enrollment. But if your drug is removed from the formulary, you qualify for a Special Enrollment Period. Contact your insurer or Medicare to request a plan change. You’ll need proof your drug was covered and then dropped.

Doris Lee

December 9, 2025 AT 23:59Just got my Tier 4 drug switched to a biosimilar last month. No warning. My pain came back hard. Took 5 weeks to get my doc to fight it. Don't let them pull this on you. Always ask if it's the same pill.

Michaux Hyatt

December 10, 2025 AT 09:51Really glad you laid this out so clearly. I used to think formularies were just about saving money. Now I see they're a maze designed to make you give up. The 73% approval rate for exceptions? That's hope. Use it. Talk to your pharmacist, ask for the formulary sheet, write down every tier change. You're not alone in this.

Raj Rsvpraj

December 12, 2025 AT 00:02Oh please. Americans complain about everything. In India, we don't even have formularies-we have survival. You get what the pharmacy has, and you're grateful. Your 'Tier 4' is our 'no medicine at all.' Stop whining about $1,650 when people die because they can't even get insulin. This isn't a crisis-it's a luxury problem.

Jack Appleby

December 12, 2025 AT 14:30Let’s be precise: the term 'therapeutic substitution' is often misused. What pharmacists are legally permitted to do in 31 states is 'pharmaceutical substitution'-generic for generic, or biosimilar for biologic. True therapeutic substitution-switching drug classes-is illegal without prescriber consent. The real issue isn’t substitution-it’s the lack of standardized, transparent formulary communication. Also, 'Tier 4' is a misnomer; it's not a tier-it's a financial abyss with no ceiling. Please consult the FDA’s 2023 guidance on biosimilar interchangeability before misrepresenting the science.

Frank Nouwens

December 13, 2025 AT 08:38Thank you for the comprehensive breakdown. I appreciate the emphasis on proactive measures-checking formularies annually, using Medicare Plan Finder, and understanding exception processes. These are not merely suggestions; they are essential practices for patient advocacy. I have shared this with my colleagues in healthcare administration. The data on prior authorization delays leading to clinical deterioration is particularly compelling.

Kaitlynn nail

December 13, 2025 AT 12:07Formularies are just capitalism in a white coat. You’re not paying for medicine-you’re paying for the right to exist. But hey, at least we got $35 insulin. Progress? Or just a PR stunt?

Aileen Ferris

December 14, 2025 AT 16:43Wait… so the government lets pharmacists swap your meds without telling you? That’s not healthcare. That’s a drug cartel. I bet the big pharma CEOs are laughing all the way to the bank. And don’t get me started on the 287-page formulary-clearly designed to confuse you so you give up. This is all a scam. They want you sick so you keep buying.

Rebecca Dong

December 15, 2025 AT 00:23MY DRUG WAS REMOVED AND NO ONE TOLD ME. I HAD A SEIZURE BECAUSE I RAN OUT. THE INSURANCE COMPANY SAID 'OH WE SENT A LETTER' BUT I NEVER GOT IT. THEY LIE. THEY ALL LIE. I’M NOT THE ONLY ONE. I’VE MET 17 PEOPLE WITH THE SAME STORY. THEY’RE KILLING US AND CALLING IT 'COST CONTROL.' I’M FIGHTING THEM. JOIN ME. #FORMULARYCRIME

Michelle Edwards

December 16, 2025 AT 12:13It’s easy to feel powerless, but you’re not. I used to skip doses too-until I started using GoodRx. Found a $12 generic for a $200 brand. Called my doctor, we switched. Took me 20 minutes. That’s the power of knowing your options. You don’t have to fight the system alone. Reach out. Someone’s got your back.

Sarah Clifford

December 17, 2025 AT 00:48My mom had to pay $800 for her heart med last year. She cried. She didn’t even tell me till months later. Now I check her plan every October like it’s my job. Don’t wait till you’re broke. Do it now. Seriously. Just do it.

Regan Mears

December 17, 2025 AT 20:32I’ve worked in pharmacy for 18 years. I’ve seen patients cry because they couldn’t afford their meds. I’ve also seen pharmacists quietly slip them samples or call doctors to help with exceptions. This system is broken-but not hopeless. The real heroes are the ones who show up, who call, who file paperwork, who say 'no' to the algorithm. You’re not just a patient. You’re a person. And your health matters more than a spreadsheet.

Ben Greening

December 18, 2025 AT 20:39While the emotional weight of these experiences is undeniable, it is worth noting that formulary management remains a necessary mechanism for sustainable healthcare financing. The introduction of cost caps under Medicare Part D in 2025 represents a significant policy evolution toward equity. Continued data-driven reform, rather than reactive outrage, will yield the most durable outcomes for patient access and fiscal responsibility.