When a life-saving drug disappears from shelves, it’s not just an inconvenience-it’s a crisis. In 2024, over 300 critical medications faced shortages in the U.S. alone, from antibiotics to insulin and heart medications. These aren’t random glitches. They’re the result of fragile, over-optimized supply chains that ignored one simple truth: resilience isn’t optional-it’s essential. The question isn’t whether another shortage will happen, but when. And more importantly, what are we doing to stop it?

Why Your Medicine Might Vanish Tomorrow

Most people assume pharmaceuticals are made close to home. They’re wrong. Around 80% of the active ingredients in U.S. drugs come from just two countries: China and India. That means a flood in a factory in Hyderabad, a trade restriction in Shanghai, or even a labor strike in Mumbai can ripple across hospitals from New York to Melbourne. The system was built for efficiency, not safety. Lean inventory. Single suppliers. Long, complex chains with 12 to 15 tiers of subcontractors. One break, and the whole thing collapses. The pandemic didn’t create this problem-it exposed it. When demand spiked, manufacturers couldn’t shift production fast enough. Raw materials stalled at borders. Shipping containers piled up. Hospitals ran out of syringes, IV fluids, and even basic painkillers. The U.S. FDA confirmed that 40% of finished drug products and 80% of active pharmaceutical ingredients (APIs) are imported. And of those, 68% come from just two nations. That’s not a supply chain-it’s a single point of failure.What Resilience Really Means

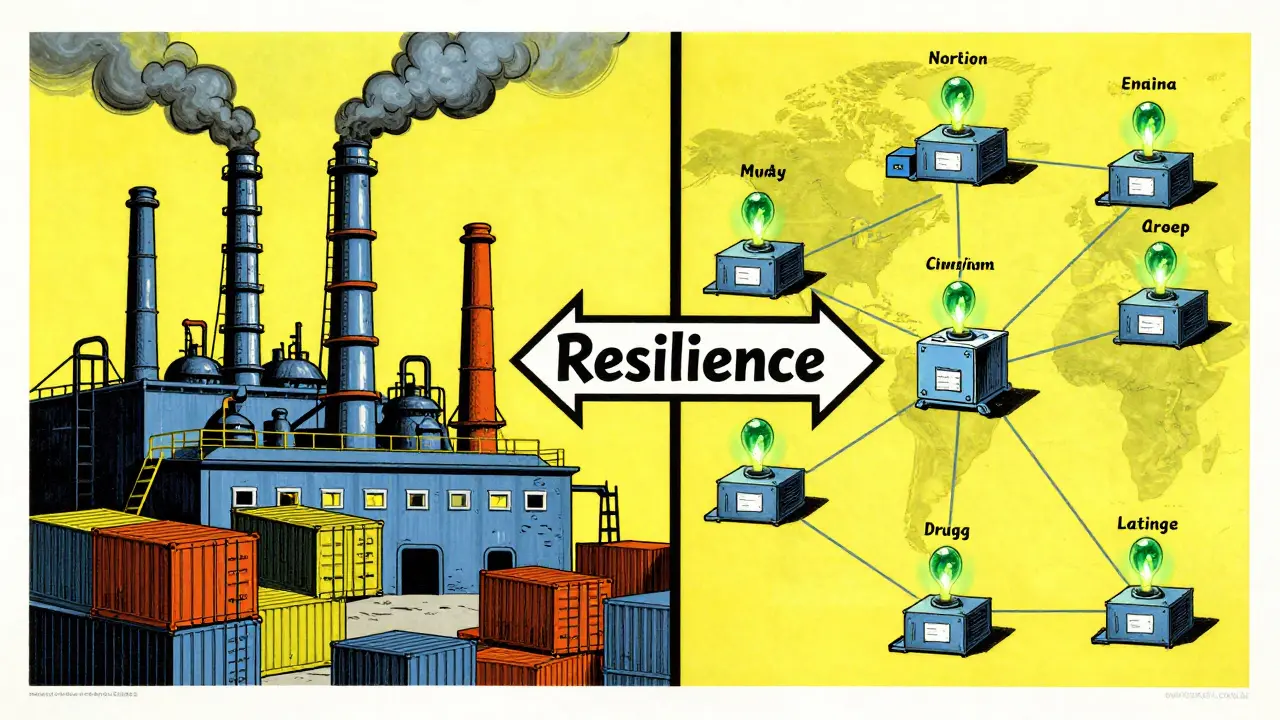

Resilience in pharmaceutical supply chains isn’t about stockpiling every drug ever made. It’s about designing systems that can bend without breaking. The Mathematica Inc. report from 2023 defined it clearly: the ability to anticipate, prepare for, respond to, and recover from disruptions while still delivering critical medicines. That means three things: preparedness, response, and recovery. Preparedness means knowing where your risks are. Leading companies now map out every supplier, down to the third-tier chemical vendor. They track which factories produce the most critical APIs. They ask: What happens if China cuts exports? What if a key plant burns down? What if a shipping lane closes? They don’t just guess-they simulate. Scenario planning isn’t a boardroom exercise anymore. It’s a daily tool. Response means having backup plans that actually work. That’s where dual-sourcing comes in. Instead of relying on one supplier for a life-saving drug, companies now secure at least two, ideally in different regions. For the most critical medications, they’re building buffer stocks-keeping 60 to 90 days of inventory on hand. That’s not waste. It’s insurance. One medtech company reduced its response time during a disruption by 50% just by having two suppliers in India and one in Mexico, instead of three all in India. Recovery means bouncing back fast. That’s where new manufacturing tech comes in. Traditional batch production takes months to set up. Continuous manufacturing, on the other hand, can be up and running in 12 to 18 months. It uses smaller, modular units-think shipping containers full of drug-making equipment-that can be shipped and installed anywhere. These systems cut facility size by 30-40%, reduce waste by 15-20%, and improve quality control. The FDA approved only 12 continuous manufacturing lines as of 2025, but that number is rising fast.The Tech That’s Changing the Game

Technology isn’t just helping-it’s redefining what’s possible. AI is now predicting supply chain disruptions 60 to 90 days in advance with 85-90% accuracy. By analyzing weather patterns, political unrest, port congestion, and even social media chatter from manufacturing hubs, these systems flag risks before they become crises. One large U.S. drugmaker cut its forecast errors by 70% in just nine months using AI-driven supply intelligence. Blockchain is another quiet hero. In pilot programs, it’s slashed counterfeit drug rates by 70-75%. How? By giving every pill a digital passport. From the raw API to the final tablet, every step is recorded on an unchangeable ledger. Pharmacies, hospitals, and regulators can verify authenticity in seconds. That’s not just about safety-it’s about trust. And then there’s continuous manufacturing. Unlike old-school batch production, where you make 10,000 tablets at a time and wait for quality checks, continuous manufacturing runs 24/7 in a single, automated line. It’s faster, cheaper per unit, and far more flexible. One company using this method reduced its production cycle from 14 days to 48 hours. That means if a hospital suddenly needs 50% more insulin, they can scale up without waiting months.

The Real Cost of Ignoring Resilience

Some executives say, “Why spend more when we’ve been fine?” But the cost of doing nothing is staggering. ZS Associates found that companies with strong resilience strategies avoided $14.7 million in lost revenue per major disruption. That’s not hypothetical. In 2023, a single API shortage cost one major hospital network $22 million in emergency purchases, overtime, and canceled surgeries. The financial burden isn’t just on hospitals. Patients pay too. When a drug is scarce, prices spike. A 2024 study showed that shortages led to price increases of 300-500% for some generic drugs. That’s why resilience isn’t just a supply chain issue-it’s a public health and economic one. The U.S. government is stepping in. In August 2025, an executive order created the Strategic Active Pharmaceutical Ingredients Reserve, aiming to stockpile 90 days’ worth of 150 critical drugs by 2027. The government also pledged $1.2 billion through the CHIPS Act for domestic manufacturing. But money alone won’t fix this. You can’t build a resilient supply chain by just making more pills in the U.S. if your workers aren’t trained, your regulations are outdated, and your suppliers are still isolated.How Companies Are Actually Doing It

The best performers aren’t waiting for government mandates. They’re acting now. Here’s what works:- Diversify geographically: Don’t put all your eggs in one basket. Leading firms now source APIs from 3-4 regions: North America, Southeast Asia, Eastern Europe, and Latin America. This cuts dependency on any single country.

- Invest in buffer stock: For essential medicines-especially injectables and antibiotics-keeping 60-90 days of inventory is now standard. It’s expensive, but cheaper than a hospital emergency.

- Adopt continuous manufacturing: Even if you’re not ready to build a full facility, pilot a modular unit. It’s like testing a prototype before going all-in.

- Use AI for risk forecasting: Start small. Use cloud-based tools to monitor supplier risk scores. Many platforms now offer free trials.

- Build cross-functional teams: Supply chain, regulatory, finance, and procurement teams must work together. Companies with siloed departments took 3x longer to recover from disruptions.

The Hard Truths No One Talks About

Resilience isn’t cheap. It adds 8-12% to the cost of goods sold. Some companies are scared. But here’s what they’re not saying: the cost of *not* doing it is higher. A single disruption can cost millions in lost sales, regulatory fines, and damaged reputation. Also, domestic manufacturing alone won’t save us. The U.S. currently produces only 28% of essential APIs. For sterile injectables? Just 12%. Antibiotics? 17%. Even if we built 10 new factories tomorrow, we couldn’t make up the gap in time. The solution isn’t isolation-it’s smart diversification. A global network with strategic domestic anchors. And let’s not forget the workforce. By 2027, the industry will be short 250,000 skilled technicians, engineers, and quality control specialists. No amount of AI or automation fixes that. Training programs, apprenticeships, and partnerships with community colleges are now part of every resilience plan.What You Can Do-Even If You’re Not a Pharma Giant

You don’t need a billion-dollar budget to start building resilience. Start here:- Identify your top 5 most critical drugs. Which ones would cause the most harm if they vanished?

- Find out where their APIs come from. Ask your supplier. If they can’t tell you, that’s a red flag.

- Ask for dual sourcing. If they only have one supplier, push for a second.

- Build a 30-day buffer stock for your top 3 drugs. It’s manageable. It’s doable.

- Use free tools. The FDA’s Drug Shortages database, WHO’s Essential Medicines list, and supply risk dashboards from industry groups can help you spot trouble early.

Why do drug shortages keep happening even with advanced technology?

Technology helps, but it can’t fix broken systems. Most shortages stem from over-reliance on single suppliers, lack of buffer stock, and poor communication between manufacturers, regulators, and distributors. AI can predict risks, but if no one acts on the warning, the shortage still happens. The real issue is organizational inertia-not tech gaps.

Can the U.S. make all its own drugs?

No, and trying to do so would be a mistake. The U.S. lacks the workforce, infrastructure, and cost efficiency to produce 100% of its APIs. Even if every factory in the country ran at full capacity, it could only cover about 40% of demand. The goal isn’t total self-sufficiency-it’s strategic independence. Focus on securing domestic capacity for the 50-100 most critical drugs, while keeping global supply chains for the rest.

Are generic drugs more vulnerable to shortages than brand-name drugs?

Yes, and for a simple reason: generics have razor-thin profit margins. Manufacturers won’t invest in backup suppliers or buffer stock if they can’t make money. Many generic drugmakers operate on 2-3% margins. When a raw material price spikes or a shipment is delayed, they shut down production rather than absorb the cost. Brand-name drugs have more financial cushion, so they’re better equipped to handle disruptions.

How long does it take to build a resilient supply chain?

It’s not a project with an end date-it’s an ongoing process. A basic resilience plan (mapping suppliers, identifying top risks, setting up dual sourcing) can be built in 6-12 months. True resilience-where you’ve tested scenarios, trained teams, and integrated AI tools-takes 3-5 years. The key is starting now. Every month you delay increases your risk.

What role do regulators play in supply chain resilience?

Regulators set the rules, but they’re often behind. The FDA has approved only 12 continuous manufacturing facilities since 2000, while over 10,000 batch facilities are in use. That’s a massive gap. In 2025, the FDA began speeding up approvals for continuous manufacturing-from 36 months to 12-18 months. That’s progress. But regulators also need to standardize global inspections and share data across borders. Resilience isn’t a national issue-it’s a global one.